Inheritance planning through strategic life insurance payouts ensures your assets are distributed according to your wishes, providing financial security for loved ones. In South Africa, life insurance is a crucial tool for effective inheritance planning, offering tax-efficient funding to cover expenses like estate duties and legal fees. Expert strategies involve aligning coverage amounts with estate value and diversifying investments within the policy, maximizing benefits while preserving the full value of your legacy for future generations.

“In South Africa, effective inheritance planning is paramount for securing your legacy. This article explores the strategic utilization of life insurance policies as a powerful tool to fund your inheritance, offering expert insights on maximizing benefits. We’ll delve into how life insurance payouts can facilitate smooth transition of assets, ensuring financial security for your loved ones. Understanding the interplay between inheritance planning and life insurance payout options is crucial for leaving a lasting impact.”

- Understanding Inheritance Planning and Life Insurance Payouts

- The Role of Life Insurance in Securing Your Legacy in South Africa

- Expert Strategies for Maximizing Life Insurance Benefits for Inheritance

Understanding Inheritance Planning and Life Insurance Payouts

Inheritance planning involves ensuring that your assets are distributed according to your wishes after your passing, providing financial security for your loved ones. In South Africa, as in many other countries, life insurance plays a pivotal role in this process. When you purchase a life insurance policy, you’re essentially making arrangements for a payout upon your death, which can serve as a substantial fund for inheritance planning.

The benefits of combining life insurance with inheritance planning are multiple. Firstly, it provides immediate liquidity to cover funeral expenses and any outstanding debts. More importantly, it guarantees a specific amount will be available for distribution among beneficiaries, ensuring they receive what you intended, without the complexities often associated with probating an estate. This structured approach to inheritance planning allows for greater peace of mind, knowing your loved ones are protected financially even in your absence.

The Role of Life Insurance in Securing Your Legacy in South Africa

In South Africa, life insurance plays a pivotal role in securing your legacy and ensuring smooth inheritance planning. A well-structured life insurance policy can provide a tax-efficient way to fund your beneficiaries’ future financial needs. When structured appropriately, the payout from a life insurance policy can cover various expenses, including estate duties, legal fees, and providing a substantial sum for your designated heirs.

This approach allows you to leave behind a lasting impact, offering peace of mind that your family will be financially secure long after you’re gone. Expert insights suggest that careful planning with life insurance payouts can help preserve the integrity of your inheritance, ensuring it reaches your intended recipients without unnecessary complications or reductions in value due to tax implications and other financial burdens.

Expert Strategies for Maximizing Life Insurance Benefits for Inheritance

Expert Strategies for Maximizing Life Insurance Benefits for Inheritance

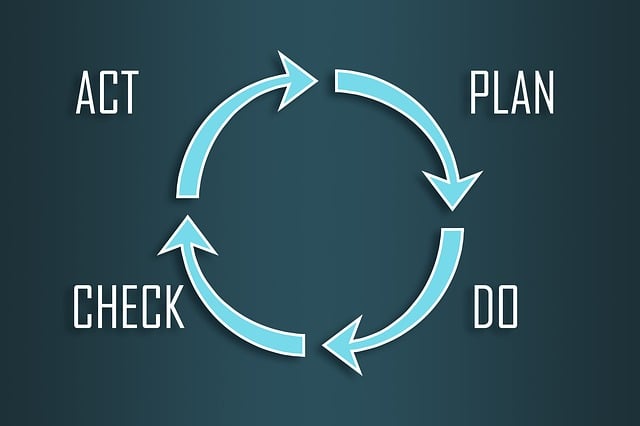

When it comes to inheritance planning, life insurance payout strategies are a powerful tool for South African families. According to financial experts, a well-structured life insurance policy can provide significant funds to support heirs and maintain family financial security. The key lies in understanding how to maximize these benefits. One strategy involves selecting an appropriate coverage amount that aligns with your estate’s value, ensuring that beneficiaries receive a substantial sum to cover immediate needs and potential inheritance taxes.

Additionally, diversifying investments within the policy is a game-changer. Many policies offer options for investing in stocks, bonds, or other assets, allowing the cash value to grow over time. This not only enhances the overall inheritance but also provides flexibility and potential income streams for beneficiaries. By combining these strategies, South African individuals can ensure that their life insurance policy becomes a robust foundation for smooth inheritance planning and financial peace of mind for future generations.